USDA loans in Kentucky offer eligible borrowers a no-down-payment way to buy a home.

With competitive, low-interest mortgage rates, USDA home loans are helping low- and moderate-income Kentucky households become homeowners.

USDA loans are home loans geared toward lower-income households and are backed by the Department of Agriculture.

While USDA loans are just one of several home loan programs backed by the US government, USDA loan requirements differ slightly from other government-backed loans like FHA (Federal Housing Administration) or VA (Department of Veteran Affairs) loans.

USDA loans in Kentucky also typically have better interest rates than FHA or VA loans.

Borrowers may sometimes hear USDA loans referred to as “RD Loans,” “Rural Development loans,” “Section 502 loans,” or the “Section 502 Guaranteed Loan Program.”

But no matter what name you call it, the USDA loan program helps eligible borrowers finance 100% of the purchase price of their homes in rural and suburban areas.

Under the USDA loan program, an area meets the definition of “rural” if its population is 20,000 or less, or in some cases, up to 35,000 if it’s rural in character and offers limited mortgage credit availability to moderate-income households. And that’s good news for most residents of The Bluegrass State because that means most of the state is eligible for USDA loans.

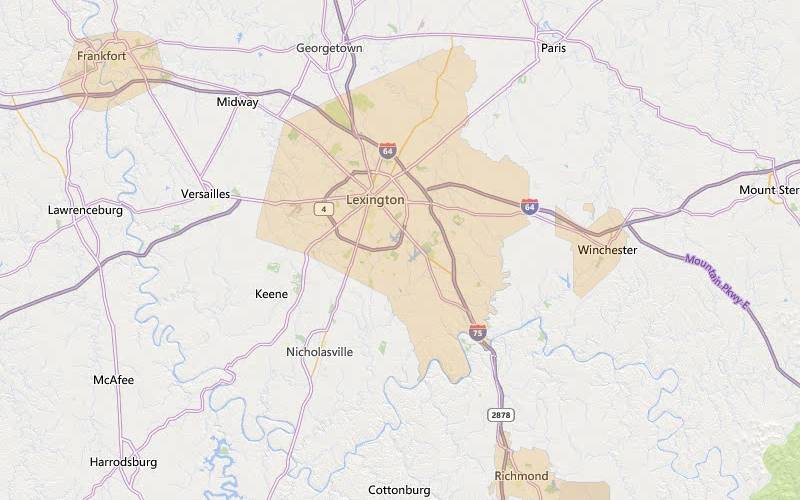

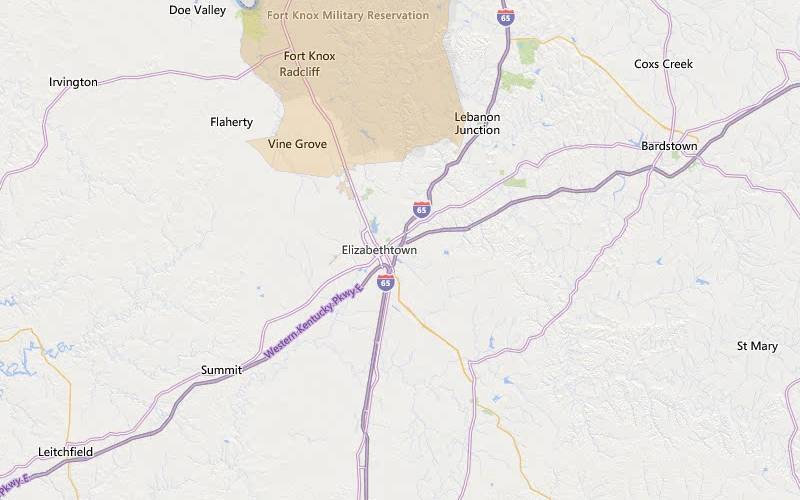

Let’s look at a few of Kentucky’s USDA-eligible areas.

Note: All non-shaded areas are eligible.

Lexington, Kentucky

“The horse capital of the world,” Lexington’s southern charm and love of horses make it a destination of choice for work and play.

Lexington’s cost of living is 10% lower than the national average, and it boasts a diverse economy with manufacturing, technology, healthcare, and education business sectors. Some of the biggest businesses in the United States, like Amazon, Lockheed-Martin, Lexmark International, IBM, and United Parcel Service, call the Lexington-Fayette metropolitan area home. Lexington also has a strong arts scene and annually hosts the country’s oldest bluegrass music festival.

Find eligible homes in nearby Keene, Nicholasville, and Lawrenceburg

Lexington median home price: $299,500.

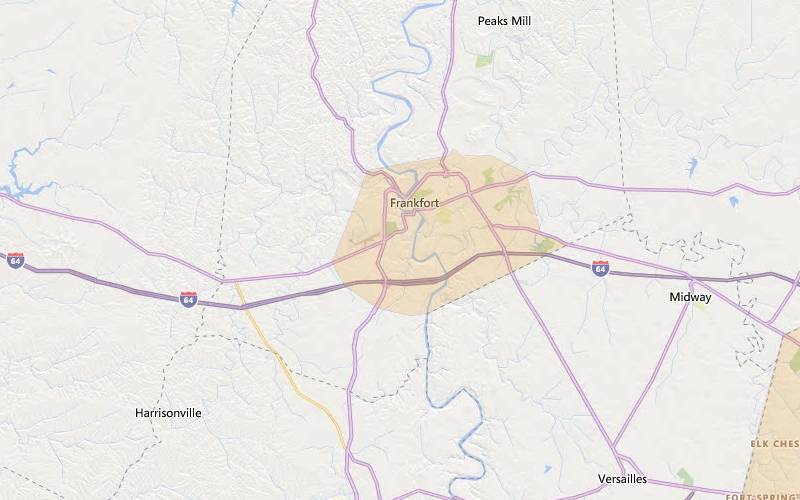

Frankfort, Kentucky

Kentucky’s capital city, Frankfort, is conveniently located east of Louisville and west of Lexington; Interstate 64 runs east-west through the city, making it a top choice for many commuters. Frankfort combines stunning natural beauty, historical and modern architecture, an abundance of southern hospitality, affordable housing, and—like most parts of the state— a cost of living less than the national average. Frankfort boasts a population of just under 30,000, with an additional 22,000 in the greater Franklin County, supporting a variety of business, education, retail, and tourism attractions without sacrificing its relaxed, small-town charm.

Find eligible properties in Peaks Mill, Midway, Bridgeport, and more.

Frankfort median home price: $219,000

Louisville, Kentucky

Situated in north-central Kentucky, Louisville is the biggest city in Kentucky and offers residents a vibrant and diverse economy across multiple sectors, including shipping and transportation, manufacturing, and high-tech. Bourbon City is also the home of Kentucky Fried Chicken, the Kentucky Derby, and the birthplace of Muhammad Ali, whom many consider “The Greatest” heavyweight boxer in American boxing history.

Louisville median home price: $223,000

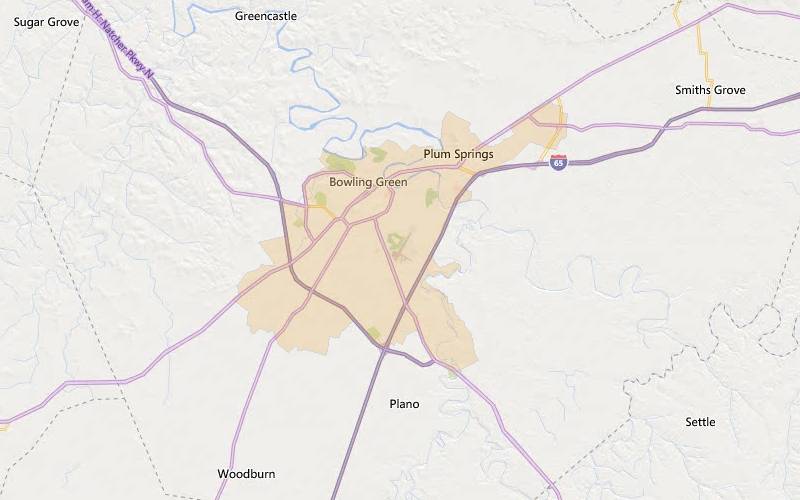

Bowling Green, Kentucky

Bowling Green’s strong economy, featuring healthcare, manufacturing, agriculture, and fuel sectors, makes it a natural hub for many major companies like Spalding, General Motors, and Fruit of the Loom. Corvette fans will know that Bowling Green has been home to the assembly plant making Chevrolet Corvettes since 1981. Bowling Green has a population of just under 75,000, and eligible homes are available in many areas surrounding the city.

Bowling Green median home price: $290,000

Elizabethtown, Kentucky

Located a stone’s throw outside Fort Knox, Elizabethtown offers a vibrant economy, including expanding manufacturing and hospitality sectors, supporting business and entrepreneurial growth and success. Elizabethtown’s cost of living is 8% below the US national average. The town of just over 30,000 features plenty of parks, bourbon tasting, retail, and entertainment opportunities for residents of all ages.

Elizabethtown median home price: $250,000

Note: If you’re considering buying a Kentucky home, it’s a good idea to check your preferred neighborhood against the USDA eligibility map. Because they define “rural” so generously, USDA loan eligibility extends into most parts of the state.

While the main focus of the USDA loan program is helping low- to moderate-income households in the state, USDA loan income limits in Kentucky do allow for a household income of up to 115% of the median income level for a given area.

The USDA loan program sets two standard income limits depending on household size.

Let’s look at a few USDA-eligible areas in Kentucky.

| County or Area | 1-4 member household income limit 2022-2023 | 5-8 member household income limit 2022-2023 |

| Bowling Green | $103,500 | $136,600 |

| Elizabethtown-Fort Knox | $103,500 | $136,600 |

| Lexington-Fayette | $103,500 | $136,600 |

| Louisville/Jefferson County | $103,500 | $136,600 |

| Owensboro | $103,500 | $136,600 |

| Evansville | $103,500 | $136,600 |

| Shelby County | $103,500 | $136,600 |

| Carroll County | $103,500 | $136,600 |

| Franklin County | $103,500 | $136,600 |

| Washington County, | $103,500 | $136,600 |

When calculating eligible household incomes, the USDA loan program looks at everyone 18 and over in the household; even if they won’t be part of the official USDA loan application, their income still counts toward eligibility.

The USDA uses this method to ensure the loan program remains available for households experiencing the greatest financial need.

To further ensure the program is accessed by those who stand to benefit most, the USDA loan program allows for certain deductions to help households come in under their income limits.

Standard deductions for the USDA loan program include the following:

Additionally, certain medical expenses, or expenses related to dependent family members or those living with disabilities, and more can help households meet income requirements.

If you aren’t certain your household income is below USDA income limits, check your income eligibility with the USDA’s income tool. Or reach out to a USDA lender in Kentucky.

USDA loans offer a zero-down home loan, but closing costs are associated with the loan program. The USDA loan program allows borrowers to use financial gifts, including down payment assistance programs, toward these fees.

Additionally, sellers can contribute up to 6% toward the total amount of closing costs.

Homeowners interested in using the USDA loan program can take advantage of any state-approved homebuyer assistance program.

The Kentucky Housing Corporation (KHC) provides financial assistance to eligible borrowers for homes up to $349,525, which they can use toward a down payment or closing costs. KHC also offers a homebuyer tax credit for eligible homeowners.

Regarding Kentucky loan limits, the Guaranteed USDA loan program uses income limits to determine home price caps.

Here’s how it works.

If your income equals the maximum loan amount for Kentucky, your annual income would be $103,500, which breaks down to $8,625 per month.

With a monthly income of $8,625, the USDA would then consider your other debts, which include mortgage principal and interest, insurance, property taxes, and any homeowner association (HOA) fees to calculate your maximum debt-to-income ratio.

Your DTI is the main factor in determining a USDA-eligible property’s upper price limit. Let’s take a look at how that might break down:

| Monthly income | $8,625 |

| Principal, Interest, tax, insurance, HOA, mortgage insurance | $2,500 |

| Front-end debt-to-income | 29% |

| Student loans, auto loans, all other payments | $1,000 |

| Back-end debt-to-income | 41% |

| Example mortgage rate | 6.5%* |

| Estimated home price based on the above | $325,000 |

Mortgage rates, payments, and fees are for example purposes only. Your costs will vary.

USDA loans in Kentucky typically use a 29/41 DTI ratio.

In other words, your housing debt, including your full monthly mortgage payment plus USDA mortgage insurance, should be no more than 29% of your total income.

Your total DTI—housing plus all other debts, like student loans or credit cards—should be no more than 41%. But there is a little wiggle room thanks to the USDA underwriting system.

The USDA’s computerized underwriting system, called “GUS,” takes things like good credit and other compensating factors into account when evaluating USDA loans in Kentucky. GUS can approve borrowers with DTI ratios above the standard 29/41 percentages.