An annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. By finding the present value interest factor of an annuity (PVIFA) on the table, you can easily determine the current worth of your annuity payments.

Jennifer Schell, CAS® Financial Writer, Certified Annuity Specialist® Jennifer Schell is a professional writer focused on demystifying annuities and other financial topics including banking, financial advising and insurance. She is proud to be a member of the National Association for Fixed Annuities (NAFA) as well as the National Association of Insurance and Financial Advisors (NAIFA). Read More

Savannah Pittle Senior Financial Editor Savannah Pittle is an accomplished writer, editor and content marketer. She joined Annuity.org as a financial editor in 2021 and uses her passion for educating readers on complex topics to guide visitors toward the path of financial literacy. Read More

Thomas J. Brock, CFA®, CPA Investment, Corporate Finance and Accounting Professional Thomas Brock, CFA®, CPA, is a financial professional with over 20 years of experience in investments, corporate finance and accounting. He currently oversees the investment operation for a $4 billion super-regional insurance carrier. Read More

Fact Checked Fact CheckedAnnuity.org partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

How to Cite Annuity.org's ArticleAPA Annuity.org (2024, August 20). Annuity Table for an Ordinary Annuity. Retrieved September 9, 2024, from https://www.annuity.org/annuities/rates/table/

MLA "Annuity Table for an Ordinary Annuity." Annuity.org, 20 Aug 2024, https://www.annuity.org/annuities/rates/table/.

Chicago Annuity.org. "Annuity Table for an Ordinary Annuity." Last modified August 20, 2024. https://www.annuity.org/annuities/rates/table/.

Why Trust Annuity.org Why You Can Trust Annuity.orgAnnuity.org has provided reliable, accurate financial information to consumers since 2013. We adhere to ethical journalism practices, including presenting honest, unbiased information that follows Associated Press style guidelines and reporting facts from reliable, attributed sources. Our objective is to deliver the most comprehensive explanation of annuities and financial literacy topics using plain, straightforward language.

We pride ourselves on partnering with professionals like those from Senior Market Sales (SMS) — a market leader with over 30 years of experience in the insurance industry — who offer personalized retirement solutions for consumers across the country. Our relationships with partners including SMS and Insuractive, the company’s consumer-facing branch, allow us to facilitate the sale of annuities and other retirement-oriented financial products to consumers who are looking to purchase safe and reliable solutions to fill gaps in their retirement income. We are compensated when we produce legitimate inquiries, and that compensation helps make Annuity.org an even stronger resource for our audience. We may also, at times, sell lead data to partners in our network in order to best connect consumers to the information they request. Readers are in no way obligated to use our partners’ services to access the free resources on Annuity.org.

Annuity.org carefully selects partners who share a common goal of educating consumers and helping them select the most appropriate product for their unique financial and lifestyle goals. Our network of advisors will never recommend products that are not right for the consumer, nor will Annuity.org. Additionally, Annuity.org operates independently of its partners and has complete editorial control over the information we publish.

Our vision is to provide users with the highest quality information possible about their financial options and empower them to make informed decisions based on their unique needs.

There are many reasons you might want to know the present value of your annuity. Chief among them is the ability to tailor your financial plan to your current financial status. The present value of your annuity is a component of your net worth, and you need this information to ensure a comprehensive picture of your finances.

An annuity table, or present value table, is simply a tool to help you calculate the present value of your annuity. As Alec Kellzi, CPA at IRS Extension Online, told us, “These tables provide factors that are applied directly to the annuity payment amount and eliminate the need for complex calculations.”

Essentially, an annuity table does the first part of the math problem for you. All you have to do is multiply your annuity payment’s value by the factor the table provides to get an idea of what your annuity is currently worth.

Annuity tables also provide a standard that can fairly value annuities of different amounts. The IRS uses standardized annuity tables to value certain types of annuities for tax purposes.

Thomas J. Brock, CFA®, CPA Investment, Corporate Finance and Accounting ProfessionalThe present value of an annuity is the current value of all future payments you will receive from the annuity. This comparison of money now and money later underscores a core tenet of finance – the time value of money. Essentially, in normal interest rate environments, a dollar today is worth more than a dollar tomorrow because it has the ability to earn interest and grow with time.

Thomas Brock, CFA®, CPA, is a financial professional with over 20 years of experience in investments, corporate finance and accounting. He currently oversees the investment operation for a $4 billion super-regional insurance carrier.

To use an annuity table effectively, you first need to determine the timing of your payments. Are they received at the end of the contract period, as is typical with an ordinary annuity, or at the beginning? Because most fixed annuity contracts distribute payments at the end of the period, we’ve used ordinary annuity present value calculations for our examples.

Here’s a step-by-step explanation of how to use an annuity table to bypass the most complex step in traditional present value calculations:

1. Identify the interest rate and the number of periods. You’ll need to know your number of payments and interest rate, which can be found in your contract.

2. Find the PVIFA on the table. An annuity table gives you the present value interest factor of an annuity, or PVIFA. The annuity table is usually structured with interest rates on one axis and the number of remaining payments on the other axis. You find the PVIFA by locating the intersection of your interest rate and the number of remaining payments on the table.

3. Calculate the present value. Once you have the PVIFA, you simply multiply it by the amount of each payment in your annuity. The result is the present value of your annuity.

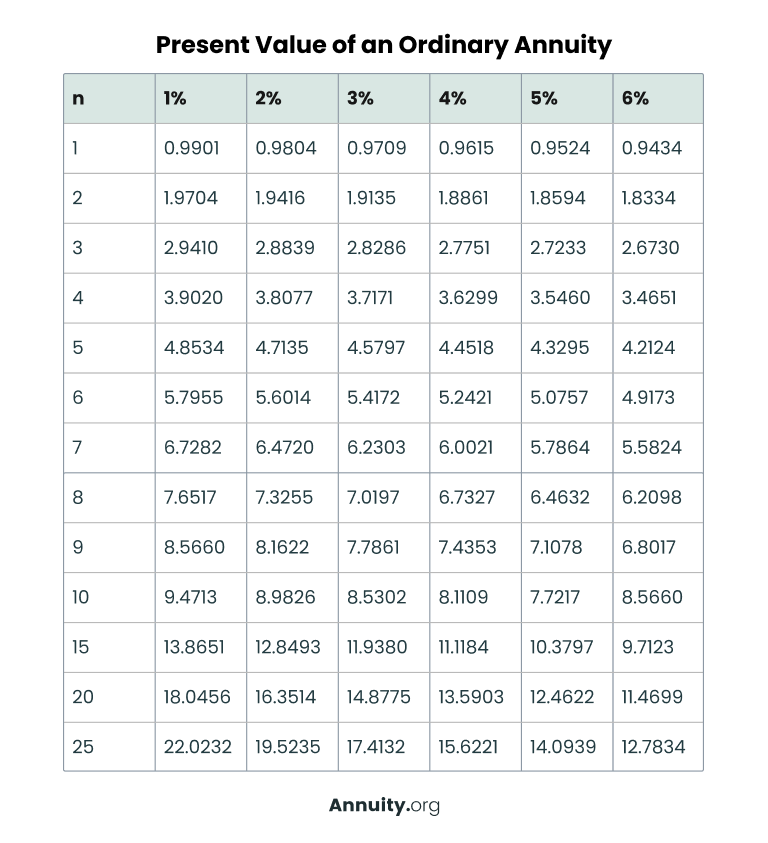

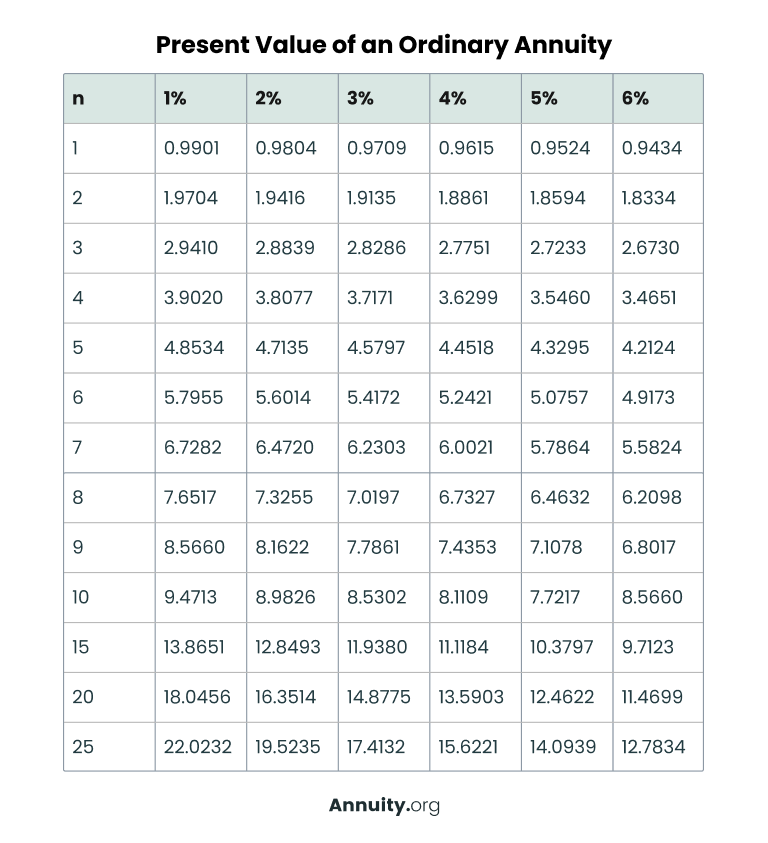

Below is an example of an annuity table for an ordinary annuity. Remember that all annuity tables contain the same PVIFA for a specific number of periods at a given rate, much like multiplication tables give the same product for any two numbers. Any variations you find among present value tables for ordinary annuities are due to rounding.

Annuity Table for Ordinary Annuities

| n | 1% | 2% | 3% | 4% | 5% | 6% |

| 1 | 0.9901 | 0.9804 | 0.9709 | 0.9615 | 0.9524 | 0.9434 |

| 2 | 1.9704 | 1.9416 | 1.9135 | 1.8861 | 1.8594 | 1.8334 |

| 3 | 2.9410 | 2.8839 | 2.8286 | 2.7751 | 2.7233 | 2.6730 |

| 4 | 3.9020 | 3.8077 | 3.7171 | 3.6299 | 3.5460 | 3.4651 |

| 5 | 4.8534 | 4.7135 | 4.5797 | 4.4518 | 4.3295 | 4.2124 |

| 6 | 5.7955 | 5.6014 | 5.4172 | 5.2421 | 5.0757 | 4.9173 |

| 7 | 6.7282 | 6.4720 | 6.2303 | 6.0021 | 5.7864 | 5.5824 |

| 8 | 7.6517 | 7.3255 | 7.0197 | 6.7327 | 6.4632 | 6.2098 |

| 9 | 8.5660 | 8.1622 | 7.7861 | 7.4353 | 7.1078 | 6.8017 |

| 10 | 9.4713 | 8.9826 | 8.5302 | 8.1109 | 7.7217 | 7.3601 |

| 15 | 13.8651 | 12.8493 | 11.9380 | 11.1184 | 10.3797 | 9.7123 |

| 20 | 18.0456 | 16.3514 | 14.8775 | 13.5903 | 12.4622 | 11.4699 |

| 25 | 22.0232 | 19.5235 | 17.4132 | 15.6221 | 14.0939 | 12.7834 |

Annuity tables estimate the present value of an ordinary fixed annuity based on the time value of money. Consider that every dollar has earning potential because you can invest it with the expectation of a return. The time value of money principle states that a dollar today is worth more than it will be at any point in the future.

Imagine you have $1,000 right now and you deposit it into a high-yield savings account offering a 1% annual interest rate. By the end of the year, your balance would grow to $1,010 because of the interest earned.

If you were to receive $1,000 at the end of the year instead, you would only have that $1,000. In this scenario, the future $1,000 is effectively worth $990 today because you missed out on the opportunity to earn that 1% interest over the year.

While this example is straightforward because it involves round numbers and a single payment period, the calculations can become more complex when dealing with multiple payments over time.

That’s where an annuity table comes in handy. The table simplifies this calculation by telling you the present value interest factor, accounting for how your interest rate compounds your initial payment over a number of payment periods.